Government plans for council tax ‘equalisation’ have been described as ‘grossly unfair’ by a West Sussex county councillor.

The proposals, which form part of the Fair Funding Review 2.0, aim to take a portion of the money collected by ‘richer’ councils, such as West Sussex, and hand it to ‘poorer’ councils – mostly in the north – which cannot raise as much.

During a meeting of the cabinet on Tuesday, July 29, Jeremy Hunt, cabinet member for finance, said: “What the government is proposing is that they will top-slice some of our council tax and send it north to councils where they assess the need is greater.”

The new funding system is expected to take effect on April 1, 2026. A consultation into the changes, which ends on August 15, does not state how much each authority will receive, with the information expected in late November at the earliest.

How the loss of funding would impact the council remains to be seen.

Mr Hunt said: “It remains a significant risk that the county council will lose funding overall. But the magnitude of that number is still uncertain.”

The county council’s deputy leader, Deborah Urquhart, said: “Our council-tax payers are hurting as much as those up north and we need to send a message to government that it is grossly unfair to our council taxpayers to place stealth taxes on them by reducing our government grant in order to fund authorities elsewhere and assuming we will increase our council tax to the maximum year after year.”

Man remanded in custody charged with Chichester stabbing

Man remanded in custody charged with Chichester stabbing

UPDATED: 31/07/2025 @ 15:24 - South braces for thunderstorms

UPDATED: 31/07/2025 @ 15:24 - South braces for thunderstorms

Delayed decision over Local Plan in Horsham

Delayed decision over Local Plan in Horsham

Brighton Pride 2025 - All you need to know

Brighton Pride 2025 - All you need to know

Boy trapped in brambles in Steyning

Boy trapped in brambles in Steyning

Digital sewers save Sussex river from pollution

Digital sewers save Sussex river from pollution

Brighton and Hove expansion plans debated

Brighton and Hove expansion plans debated

Violence on the rail network in the South East is on the rise.

Violence on the rail network in the South East is on the rise.

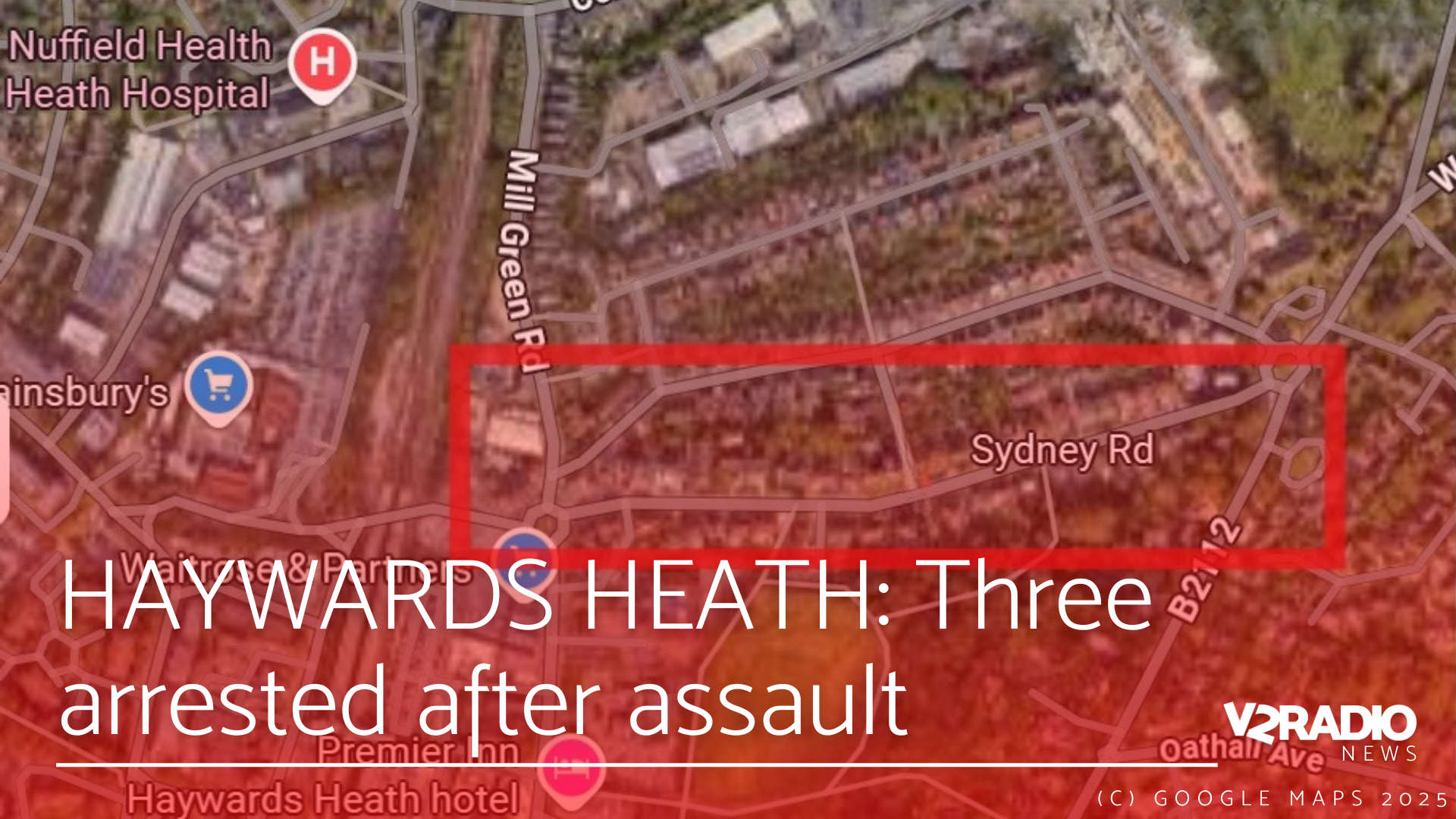

Three arrested after Haywards Heath assault

Three arrested after Haywards Heath assault

Increase in wildfires in Hampshire

Increase in wildfires in Hampshire